You can open the Tax Deductible Donation Letter Template in multiple formats, including PDF, Word, and Google Docs.

Tax Deductible Donation Letter Template Printable | Editable FormSample

Examples

[Name of the Donor]

[Donor’s Address]

[Donor’s Phone]

[Donor’s Email]

[Name of the Charity/Organization]

[Organization’s Address]

[Date]

Tax Deductible Donation Confirmation

I am writing to confirm my donation made to [Name of the Charity/Organization] on [Donation Date] in the amount of [Donation Amount]. This contribution is intended to support [Specify purpose or project for which the donation is made].

This letter serves as a receipt for your records indicating that no goods or services were provided to me in return for this donation, which is a requirement for tax deduction purposes.

I confirm that my donation is fully tax-deductible as [Name of the Charity/Organization] is a registered 501(c)(3) nonprofit organization under the IRS guidelines. Please find my donation referenced below:

– Donation Amount: [Donation Amount]

– Donation Method: [Cash/Credit Card/Check]

– Check Number (if applicable): [Check Number]

Thank you for the incredible work that [Name of the Charity/Organization] is doing. I am proud to contribute to your initiatives and support your mission.

[Signature of the Donor]

[Name of the Donor]

[Name of the Donor]

[Donor’s Address]

[Donor’s Phone]

[Donor’s Email]

[Name of the Charity/Organization]

[Organization’s Address]

[Date]

Receipt of Charitable Contribution

This letter serves to acknowledge my contribution made on [Donation Date] with a total amount of [Donation Amount] to support the mission of [Name of the Charity/Organization].

As a nonprofit organization recognized by the IRS as a 501(c)(3), this donation qualifies as a tax-deductible contribution. No goods or services were provided in exchange for this donation.

– Donation Amount: [Donation Amount]

– Donation Type: [Cash/Credit Card/Check]

– Transaction ID (if applicable): [Transaction ID]

Your generosity enables [Name of the Charity/Organization] to continue our efforts in [Briefly describe the mission or service the charity provides].

Thank you for your support and commitment to our cause. We truly appreciate your contribution.

[Signature of the Donor]

[Name of the Donor]

Format

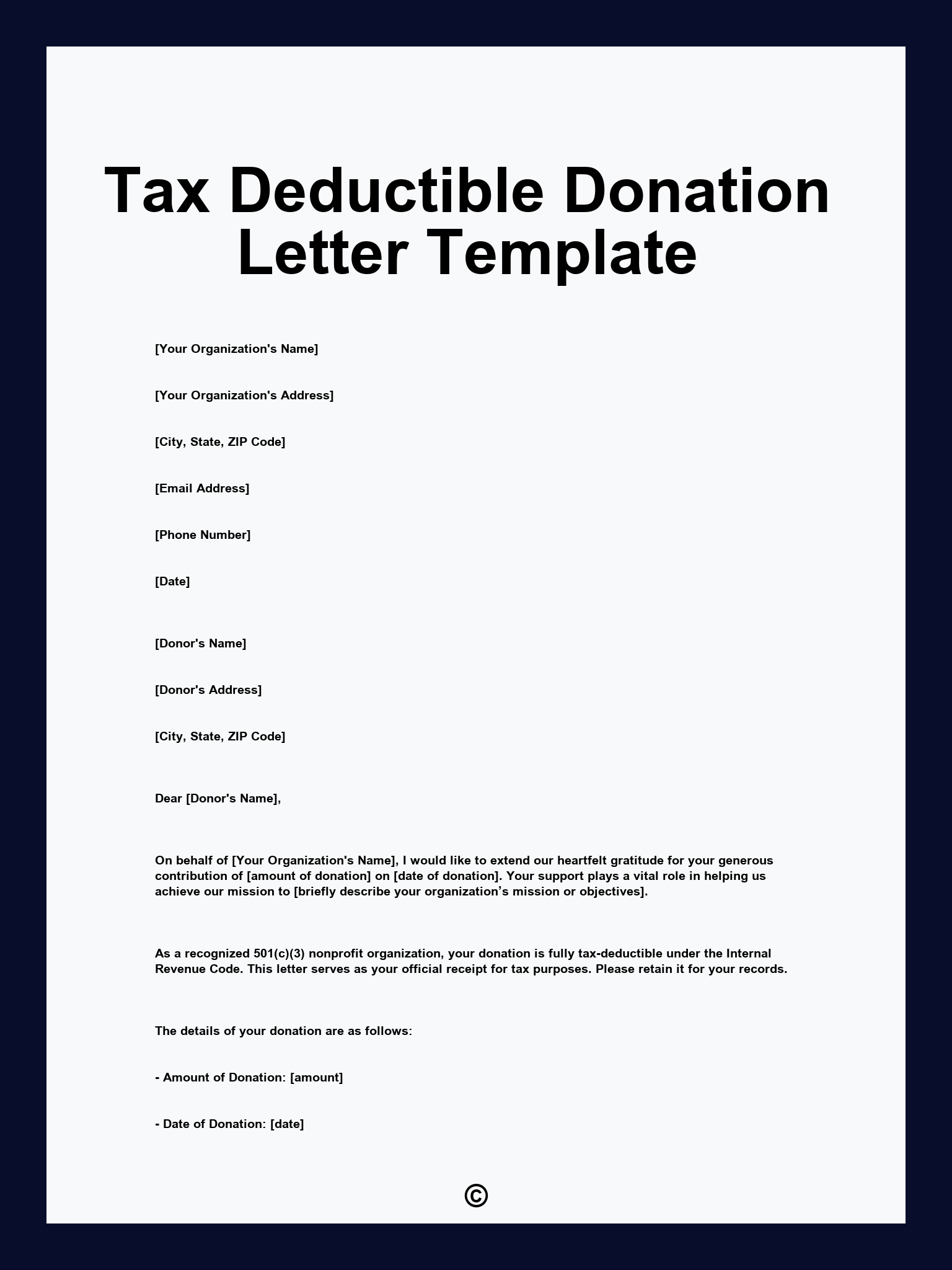

Please complete the form below to create the Tax Deductible Donation Letter Template. All fields must be filled out to ensure that the letter meets the requirements for tax deductibility. We provide examples to guide you through each step. Tax Deductible Donation Letter Template 1. Donor Information 2. Organization Information 3. Donation Details 4. Acknowledgment and Purpose of Donation 5. Non-Refundability Clause 6. Contact Information 7. Organization’s IRS Status 8. Signature and Date

PDF

WORD

Google Docs

Tax Deductible Donation Letter Template Printable | Editable FormPrintable